+2712 88 00 258

KB20210920/01: Sage X3 Tip & Trick – Capitalizing expense to current NBV

When you capitalize additional expense to an existing asset and want to the cost to be added to the asset NBV as at the current period and not from the NBV from the start of the financial year which will result in a depreciation adjustment. So, the solution is to depreciation method must be changed to the RE – Residual method. This method is similar to the UL – straight line method but calculates from the effective date instead of the depreciation start date.

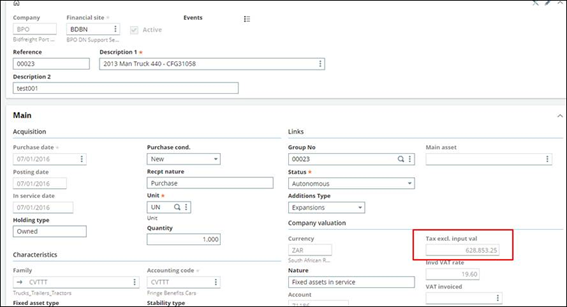

1. Before capitalizing the addition cost, confirm on the Main tab that there is a “Tax excl. input val” value.

a. The reason why this is import, is because if that field is blank, the additional cost will become the total cost which will lead to incorrect depreciation.

b. If there is a value in the field, the additional cost will be added to the current cost.

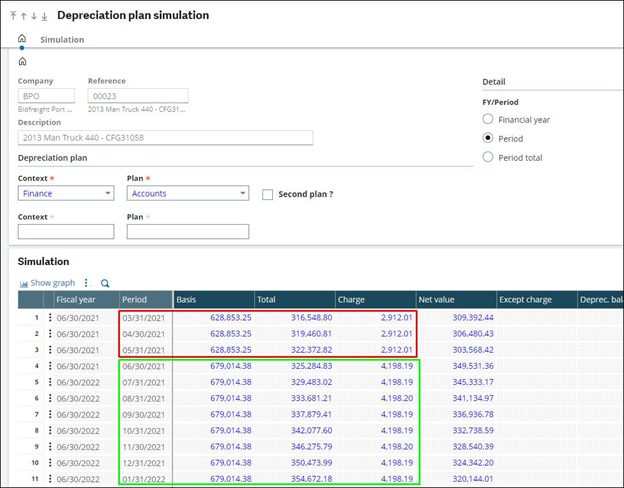

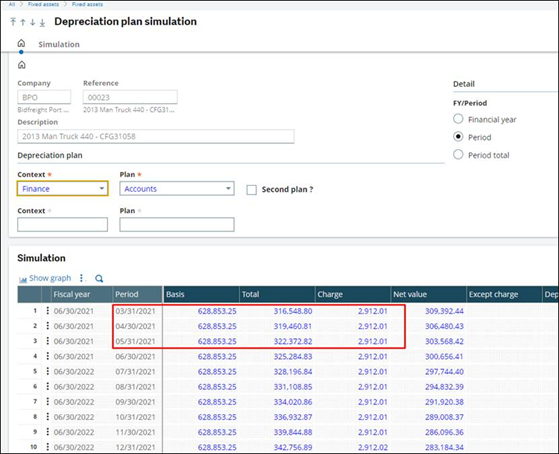

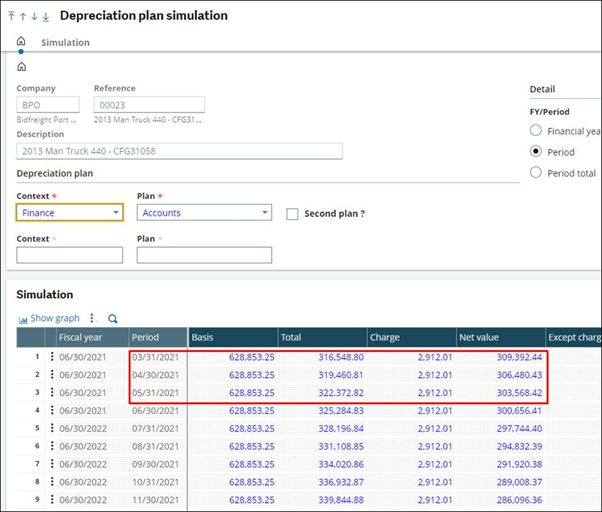

2. In this exercise, this is the current depreciation before the capitalization of additional cost – R2 912.01

3. Before you capitalize the expense, first change the depreciation method to RE – Residual.

4. So, you have two scenario,

a. The asset was initially created with the UL method, then you have to change it to the RE method or;

b. The asset was initially created with the RE method, then you have to change to the SA – Without depreciation first and then immediately change it back to the RE method.

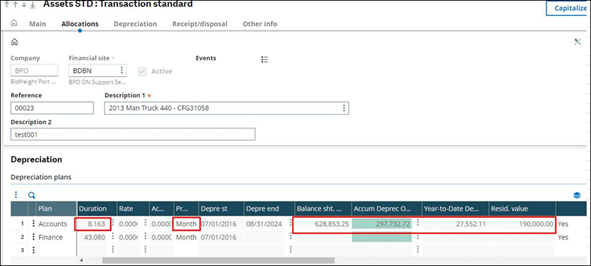

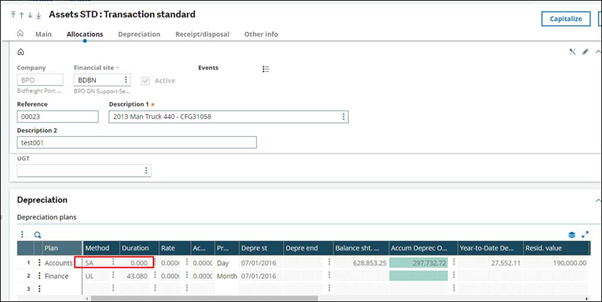

5. In this exercise, the asset was initially created with the RE method so it would be the second scenario in point 4. Above. Before changing the depreciation method, first take note of the values on the [Depreciation] tab, so it can be used to change back to “RE”.

a. Note the following:

i. Duration

ii. Proportion is monthly

iii. Balance sheet value,

iv. Accumulated depreciation opening balance

v. Depreciation Year-to-date value

vi. Residual value

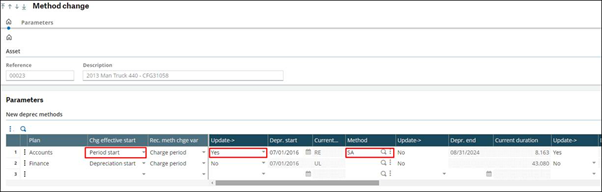

6. Now I do the actual change from “RE” to “SA”

a. Make sure that the “Change effective start” is set as “Period start”.

i. This means when you capitalise addition expenses, the cost will be added to the NBV as per the current period.

b. Update the depreciation method from “RE” to “SA”, click “OK” and save the change.

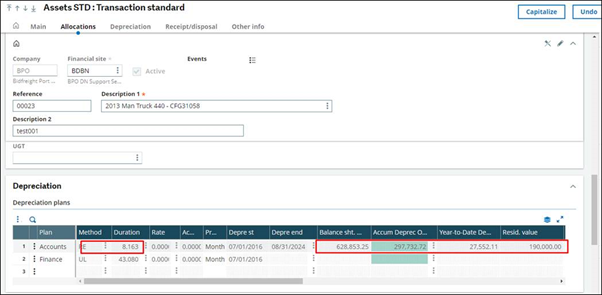

7. Now you can see on the [Depreciation] tab that the method changed to “SA”

8. Then change it immediately back to “RE” as per the values in step 5 above.

a. Make sure that the “Change effective start” is set as “Period start”.

b. Update the method from “SA” to “RE”.

c. Update the Depreciation duration as per step 5 above.

d. Prorata = Monthly

e. Enter the residual value as per step 5 above, if applicable.

9. Now everything is back to what it was before the changes as well as the Plan simulation shows the depreciation is the same as well R2 912.01

10. Now the last step, when you capitalize the expense, the expense gets added to the existing cost.

11. The Plan simulation is calculating as expected by increasing the depreciation going forward, no depreciation adjustments in the current period.