+2712 88 00 258

KB20230510/01: Sage 200 Evolution – Why use the Fixed Assets module?

Why use the Fixed Assets module and why Fixed Assets are about more than depreciation?

Accountability:

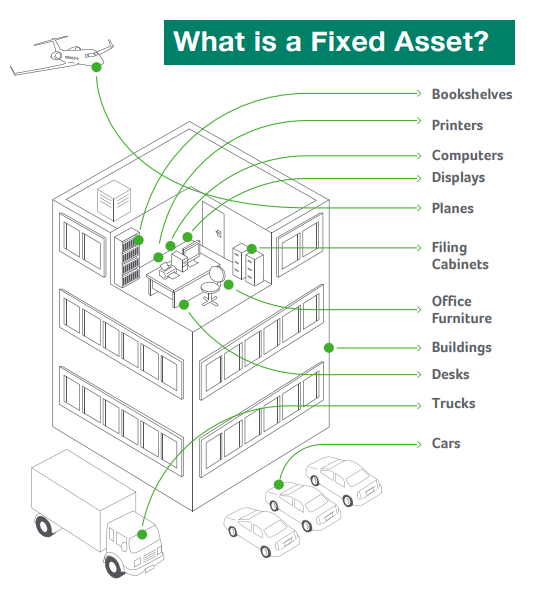

Whether you are reporting to senior management, a government agency, internal/external auditors, donors and executive boards, you are accountable for the status and value of your organization’s many Fixed Assets. Those Fixed Assets can take the form of buildings, machinery, computers, other electronic equipment, office furnishings, and even assets you build. Accurately tracking Fixed Assets’ varied lifecycles can be a daunting task, especially when there’s so much at stake.

You need to:

- Constantly stay in compliance with the latest (and ever-changing) regulations or risk being penalized.

- Be prepared for an unforeseen disaster and have the capability to recover quickly.

- Make sure you’re not overpaying on taxes and insurance, while taking advantage of the most current tax credits.

- Optimize your and your staff’s time to eliminate redundant and repetitive activities.

Any one of these responsibilities is stressful, but taken all together they can be overwhelming.

We can assist you in taking the headaches out of Fixed Asset Management with comprehensive solutions to minimize your liability and maximize your investment. In other words, we can help make your job a whole lot easier.

Below follows all the areas to consider when it comes to proper Fixed Asset Management. With this you will discover how we can assist in improving your overall operational efficiencies.

Disaster recovery

No one wants to contemplate a disaster. That’s precisely why you need to. Hurricanes, earthquakes, tornadoes, floods, storms, and blizzards are facts of nature. And what about accidental disasters such as office fires (and resulting water damage), HVAC failures, power outages, or construction damage?

Your office and records could be subject to one or more disasters—but you’re not off the hook. Operations, including tax filings, must continue regardless.

Ironically, disaster recovery is more about what you do beforehand than in the aftermath. Some questions to consider:

- How many and what kind of fixed assets do you have?

- Are they insured for the right amount?

- What is the replacement value?

- How much can you claim after a disaster?

- And even more importantly, in addition to physical assets, what if all your records are destroyed? Preparation, preparation, preparation. SysfinPro can help you plan to prepare. You’ll know exactly where you stand with your Fixed Assets’ worth, how much they should be insured for pre-disaster, and what you can expect for a replacement value. And backing up records to a safe location is a simple process, so you won’t have to “guesstimate” your true losses and expected pay-out.

Cost saving

As your organization’s Fixed Asset inventory grows, so does the amount of taxes and insurance you pay. The list just keeps getting longer as you acquire the latest “thing” to keep you operating at peak performance.

Also be wary of “ghost assets” you may have hanging around, if not on your physical site, then definitely on your books. “Ghost assets” (lost, stolen, or unusable items that are not properly accounted for), can comprise as much as 15 to 30 percent of a company’s total property, plant, and equipment.

Insurance fees and taxes are steep enough for items that you actively use, so why pay for things that no longer exist? The most effective weapon against “ghost assets,” is an accurate inventory, so you know exactly what is where and when to eliminate it from your ledger.

We can help reduce the huge job of inventory tracking to a manageable, even easy, process. You’ll be able to reconcile your asset data in one central location to maximize efficiencies and take advantage of significant cost savings.

Time efficiency

Time is money, so make sure to invest yours wisely. Maybe you (or your staff) are involved with one or more of these Fixed Asset Management time sinks:

- Rekeying data from one application/spreadsheet/form to another. Not only is it a drain on resources, but error-prone as well.

- Running reports for various groups who want to see much of the same data, but in different formats.

- Endlessly tracking the latest developments in tax rules.

- Triple and quadruple checking that your books are in compliance and ready for an audit.

Spare yourself the drudge and uncertainty with a Fixed Asset solution that:

- Integrates with your accounting system to easily share information back and forth.

- Includes options to easily customize the format, appearance, and context of your reports.

- Follows all the changes in legislation and makes updating your system a breeze.

- Incorporates a unique “Audit Advisor” that proactively identifies potential areas of noncompliance. That solution is Sage Fixed Assets.

Managing every step of the Fixed Asset lifecycle

Depreciation – Enjoy simplified fixed asset tracking with comprehensive depreciation calculations and regulations for businesses, governments, and non-profits.

Tracking – Conduct thorough physical inventories of your fixed assets with an easy graphical step-by-step process.

Planning – Take control of your Fixed Assets before they even become fixed assets with flexible management of capital budgeting and construction-in progress projects.

Reporting – Create an endless variety of custom reports, including charts, graphs, and advanced formatting options.

Services – Get up and running quickly with customized inventory and professional services as well as expert, hands-on training.