+2712 88 00 258

KB20210211/02: – Sage X3 Tip & Trick – When is the Invoices to receive function used

The function is used as a month end procedure to account/accrue for Purchase invoices that have not been received from suppliers. These invoices will arise from Purchase receipts created in the relevant period but not yet invoiced. This function also automatically generates the reversal entries for the accruals on the specified reversal date which normally is the first day of the next month.

PLEASE NOTE: You will not make use of this functionality if the Non-stock GRNI patch has been implemented, else you will double account and create duplicates. The Non-stock GRNI patch allows you to create and post the expense upon receipting.

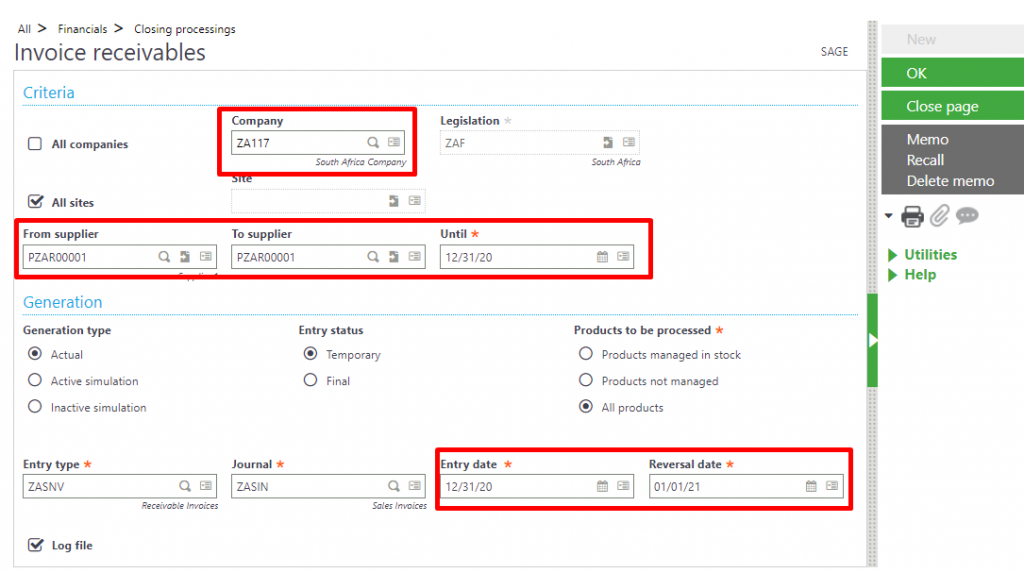

1) Navigate to Financials> Closing processings> Invoices receivable

a) Select the company and site

b) Select the Supplier range or leave blank to include all die suppliers

c) Select the “Generation type” and “Entry status” for the accrual entries

d) Enter the “Entry date” for the accrual entry which will normally the end of the financial month and the “Reversal date” will be the first day of the next month.

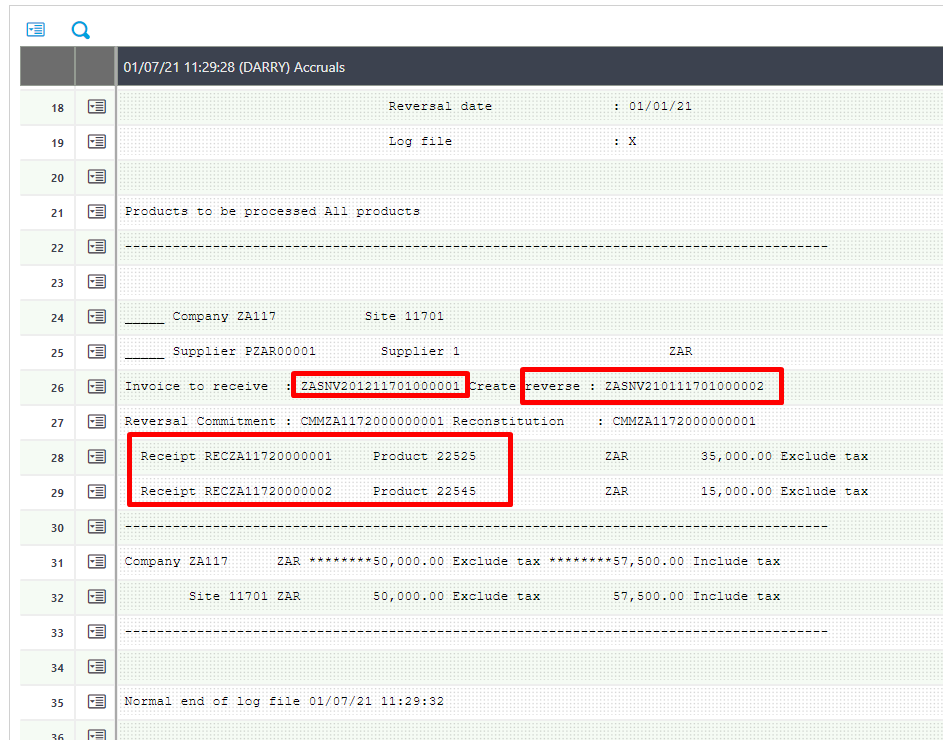

2) Once all the necessary fields are entered, click [OK] on the right panel to run the process

a) There were 2 purchase receipts that were not invoiced

b) The system created one journal to accrue for both receipts as well as the reversal thereof the next day

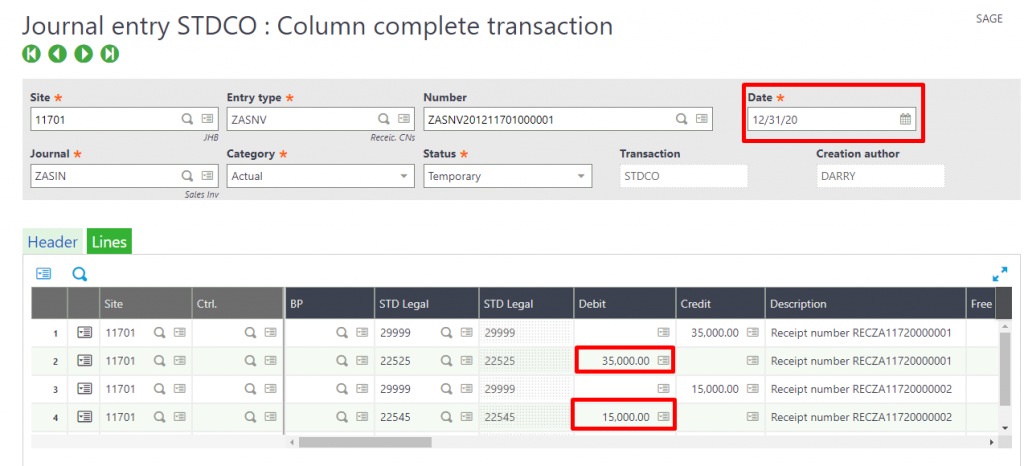

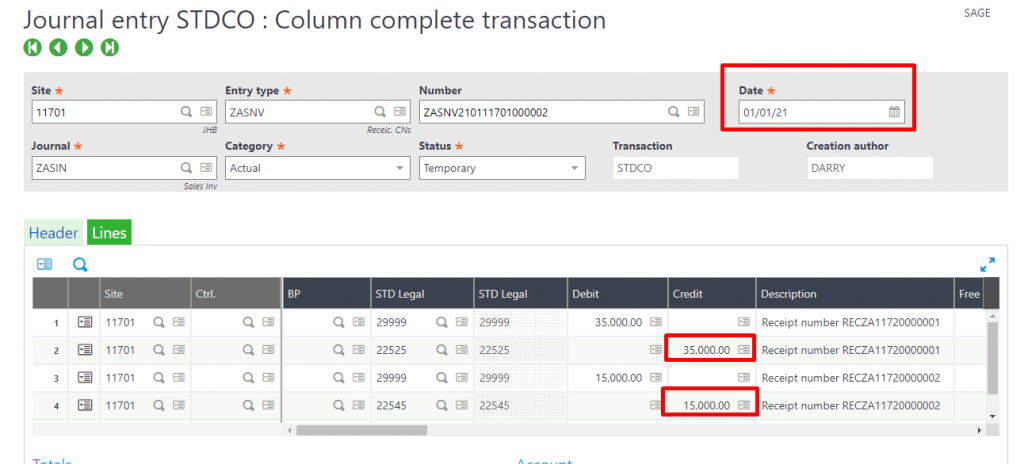

3) Lastly, let’s have a look at the journals

a) Accrual journal (Last day of the month with both expenses’ accrual for)

b) Reversal journal (First of the next month with both accruals reversed)

For more information on Sage X3 please contact us on info@sysfinpro.com or by phone on +27 12 880 0258.