+2712 88 00 258

KB20210208/01: Sage X3 Tip & Trick – Why is the Doubtful Debts entry used and how do you set it up

The doubtful receipt entry is used to create provisions for customers that have been identified as having a doubtful possibility of paying their debts. These payments are linked to validated payments (deposited in the bank) from the customers. This process represents the last stage in the customer risk management, as it mitigates risk of non-payments, disrupting cash flow within the company’s daily activities.

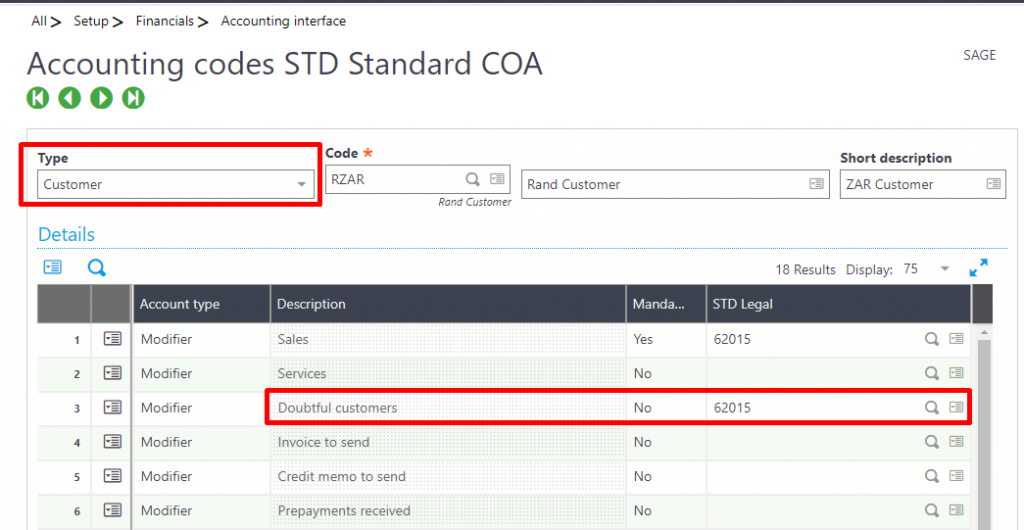

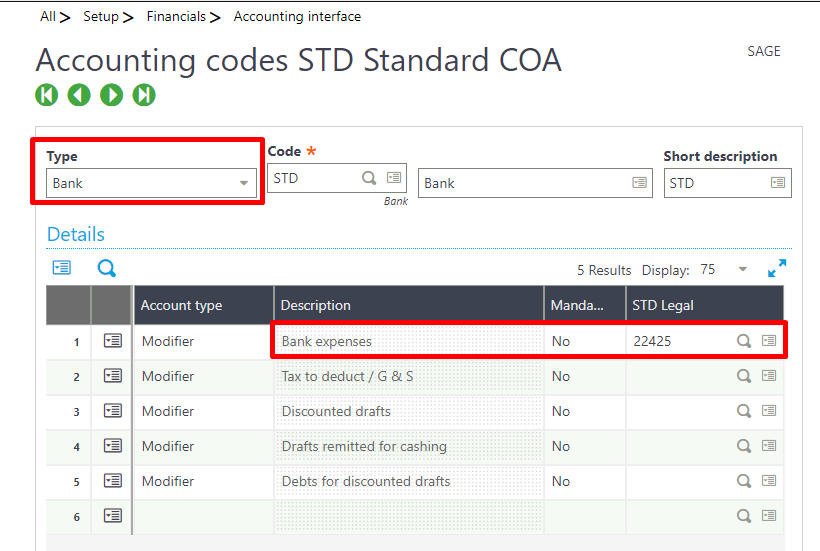

1) Confirm the “Customer” and “Bank” Accounting code is setup correctly

a) Customer Accounting code:

b) Bank Accounting code:

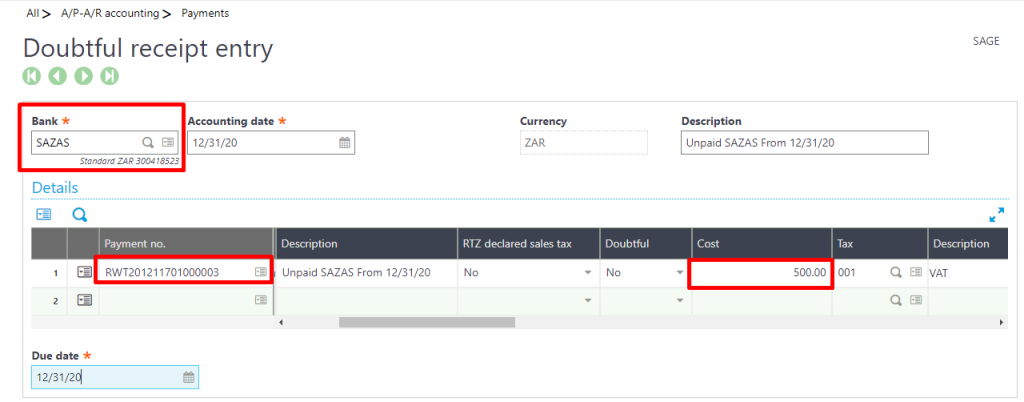

2) Navigate to A/P-A/R Accounting> Payments> Doubtful Receipt Entry

a) Select the relevant bank that the payment receipt was made to

b) Select the payment that must be linked to the doubtful entry

c) Enter the cost being written off as a doubtful debt

d) Click [Save] to create the accounting entry

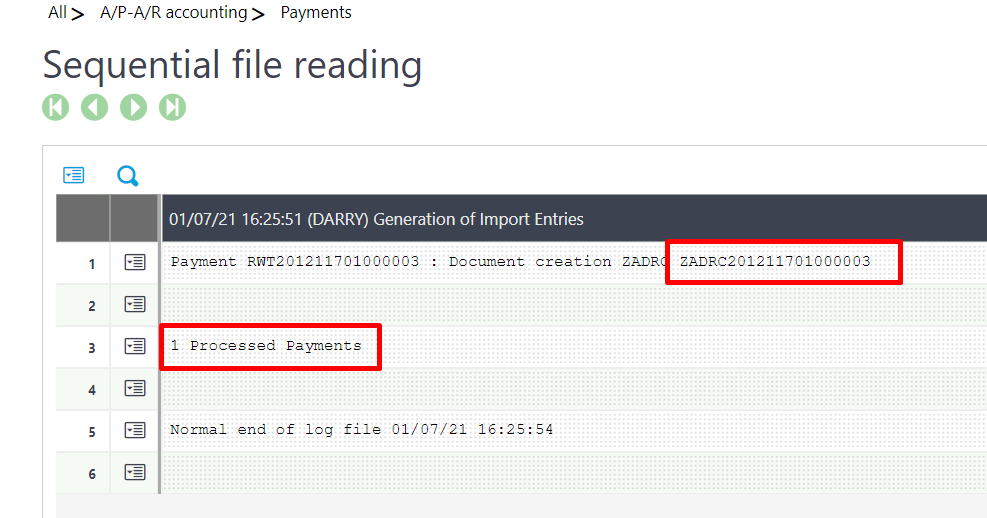

e) The log file will display the accounting entry reference

For more information on Sage X3 please contact us on info@sysfinpro.com or by phone on +27 12 880 0258.